Case Study

Credit Card Surcharging at Music Events: A Smart Strategy and Seamless Experience

In the live music world of today - from intimate venues to sprawling festivals, attendees expect more than just great music, they expect speed, they expect convenience, and they expect flexibility when they make purchases. With rising credit-card interchange fees (typically 2-4%), event organizers are increasingly turning to credit card surcharging (a targeted fee on card payments as a smart and transparent solution).

Why Surcharging Works for Music Events

- High spend, low resistance

At music festivals, spending isn’t just ticket price, drinks, merch, VIP upgrades - attendees routinely drop $100–$299 annually, with over 20% exceeding $500. When funds are flying fast in a memorable moment, a modest 2–3% surcharge hardly registers. PYMNTS reports 85% of consumers accept surcharges, and only ~21% felt less satisfied from pymnts.com. - Enabling cashless convenience

Cashless payments via: cards, digital wallets, wristbands are dominant in festivals: > 75% of fans prefer these options. Surcharging simply aligns the business model with this preference while keeping operations lean and efficient. - Protecting margins

Interchange fees chip away at slim profit margins. On a 20% margin product, a 3% fee is meaningful. Passing the cost ensures customers using convenient payment methods absorb the fee - not the event. - Captive Audience

Festivals create a closed-loop environment where attendees are immersed in the experience, often having limited access to outside options. This gives event organizers a unique opportunity to set clear expectations around surcharging and implement consistent policies across all vendors. When communicated upfront and applied uniformly, surcharging then becomes normalized - resulting in attendees being less likely to push back when there are no alternatives, and more likely to focus on the music, not the margin.

Industry Landscape & Regulatory Overview

- Uptick in surcharging by small businesses: A JD Power survey reported that a third of small businesses in the U.S. 34% are now adding surcharges to credit card transactions. The data analytics firm surveyed 3,841 U.S. small businesses in 3 months and found that those 34% said they added a surcharge when a customer paid with a card. This was the first J.D. Power survey that included a question about surcharges and credit cards. retaildive.com

- Consumer awareness rising: 81% of shoppers support legislation enabling competition to reduce swipe fees National Retail Federation here. Showing a growing understanding of how credit card processing impacts prices. As this awareness increases, consumers are becoming more accepting of credit card surcharges at events and venues whether they like it or not. Recognizing it as a transparent way for businesses to offset rising costs without inflating base prices.

- Legal compliance matters: Surcharge caps at 3-4%, debit cards exempted. Some states prohibit surcharging which venues must stay informed on. At Billfold we have developed the solution to keep you fully compliant with all regulations.

A Venue’s Case Study: How Surcharging Delivers Value

Recover ~3% on all card purchases, preserving existing margins

Most consumers pay surcharges without complaint

Optimized pricing transparency

Visibly separates cost-of-payment from product price

Optionally offers a small cash discount to promote lower-fee payments

Even with minor consumer dissatisfaction, most attendees stay loyal, especially when the surcharge is clearly communicated and contextualized as a fairness measure.

From The Customer:

In addition, the industry seems to already be accustomed / trained to extra fees across the board. Take ticket sales for example. This article reported by thesmudgereport.com states: “Here’s the catch: some loyal fans are unfazed by these prices. (That’s if they’re able to get their hands on a ticket in the first place.)” Jessica, a 36-year-old communications manager, says. “Music has always spoken to me and been the number-one thing to help me heal if I’m in an emotional rut, so I’m willing to spend a lot of money on a live show.”

Why Billfold POS Champions Surcharging for B2B Clients

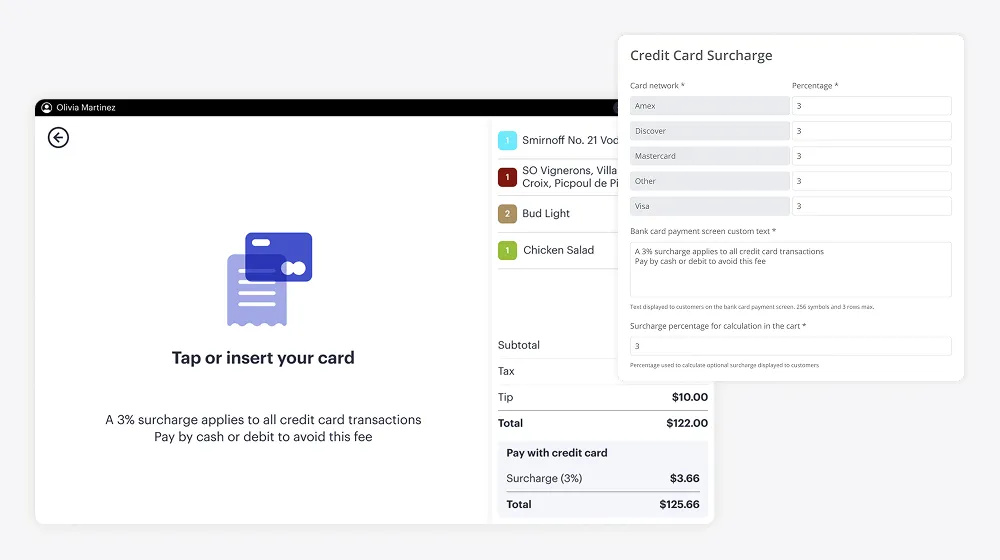

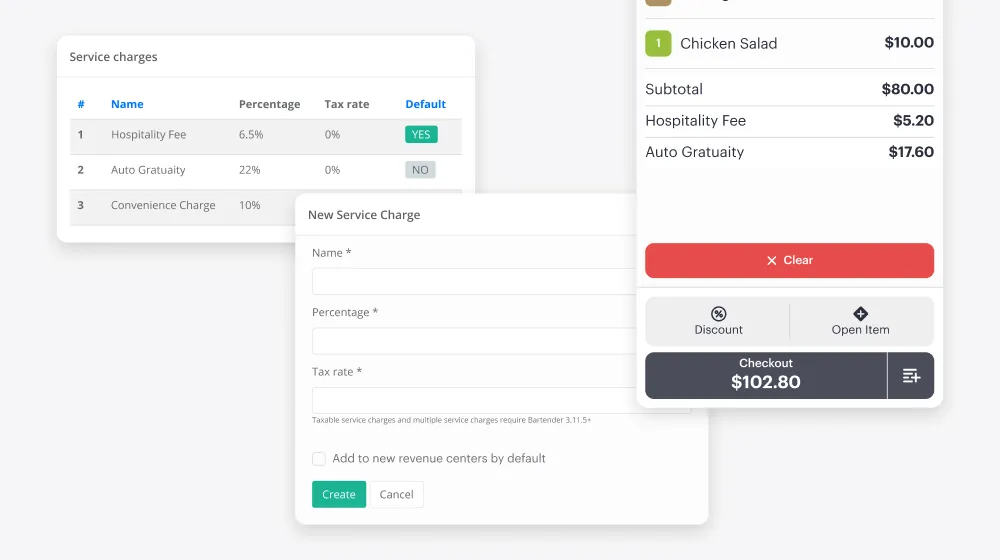

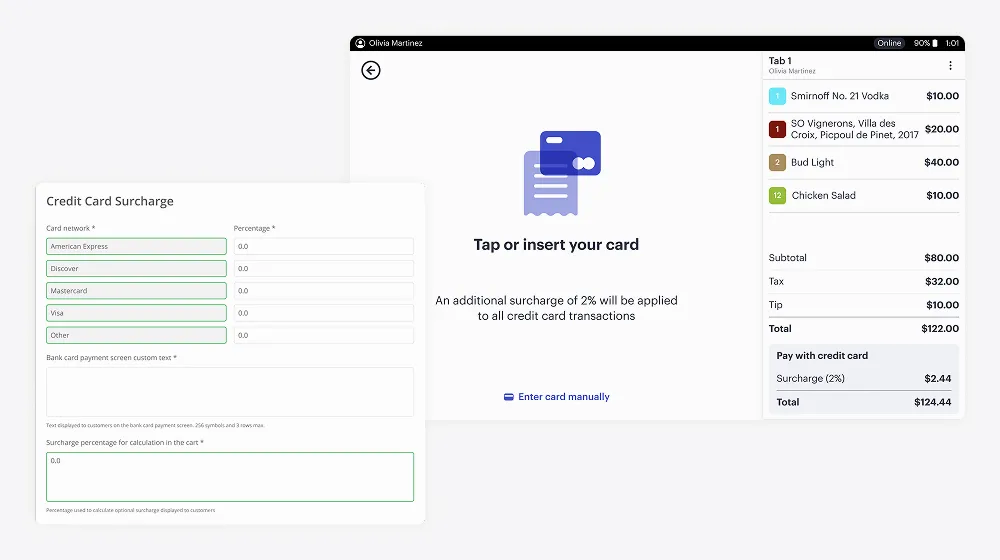

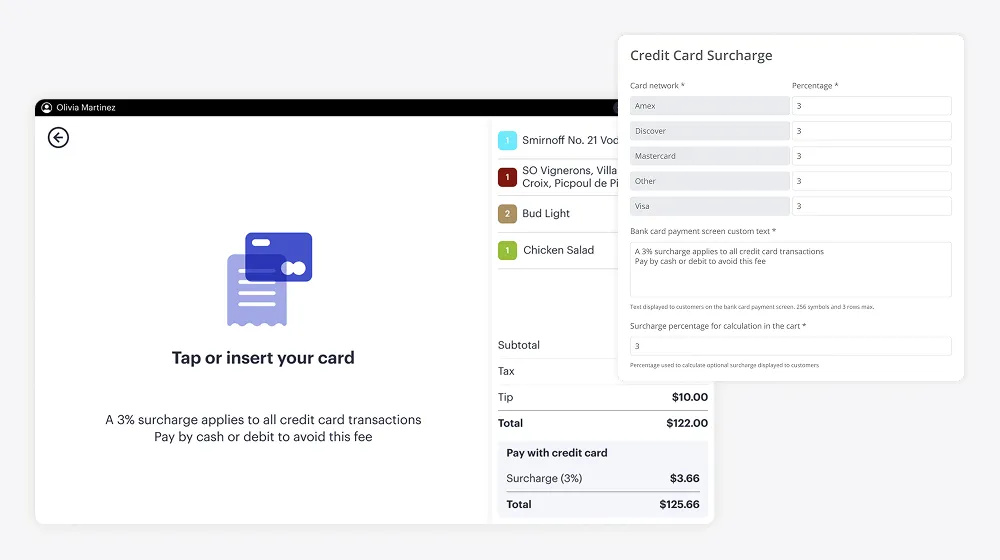

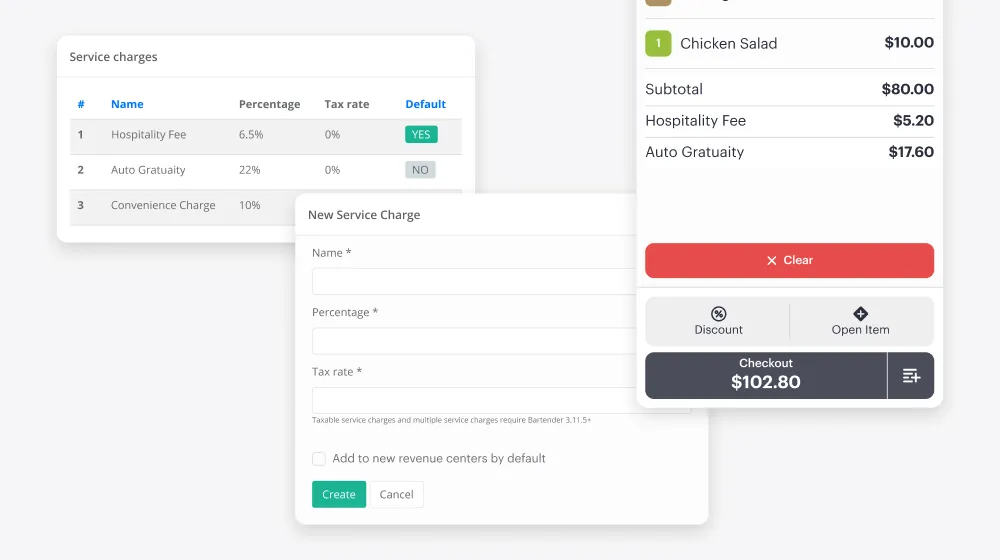

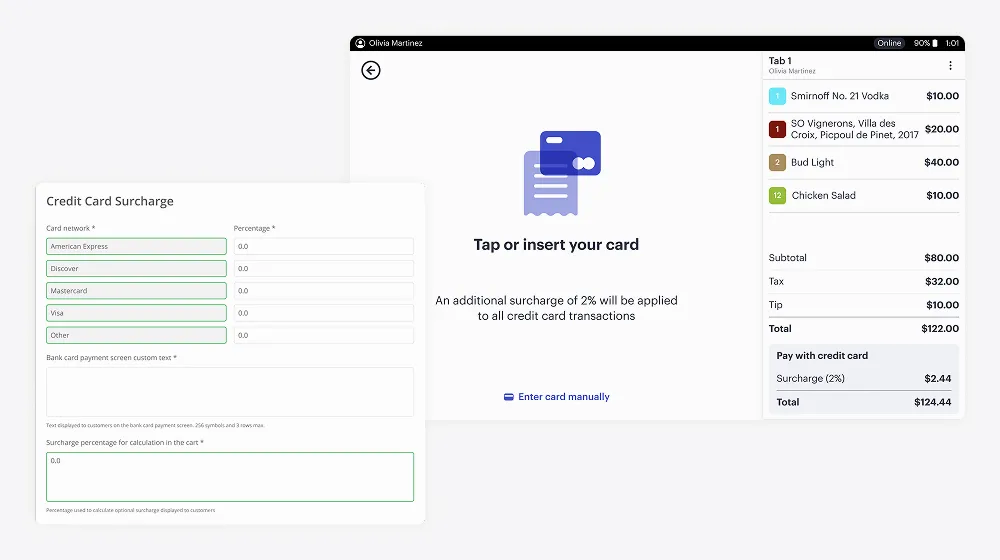

As event tech experts, Billfold POS offers venues and festivals a compliant, seamless surcharging solution:

- Full regulatory compliance: Automatic fee caps, proper signage, and receipts = no legal headaches.

- Automated workflows: Billfold applies the surcharge only to credit-card transactions, with no manual intervention.

- Revenue insights: Robust analytics show how surcharged income offsets processing costs over time.

- PR-friendly billing design: Customize messaging to highlight surcharging as a choice - not a penalty.

Why Your Organization Should Care

- Protect your profitability

As interchange fees grow, parity pricing becomes harder. Surcharging offsets that pain point without affecting the attendee experience. - Make transparency a selling point

Promoting surcharges as “covering the cost of convenience” can resonate well with socially conscious consumers who expect honesty. - A solution to successful sales

Creating a strategic advantage for your event: improved margins, operational simplicity, and an attendee-friendly payment model.

Pro Tips for Rolling Out Surcharging at Events

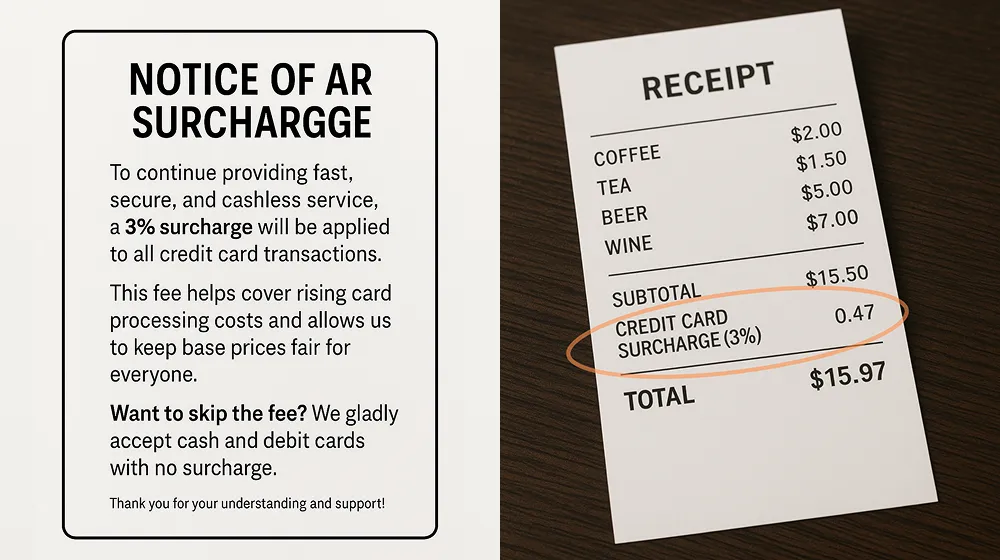

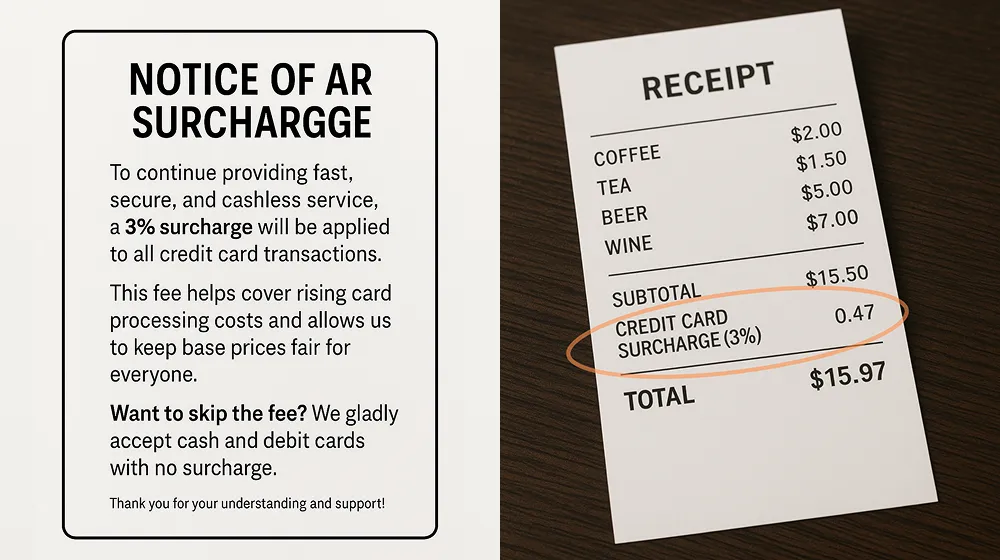

- Signage is essential: Include point-of-sale notices and web reminders.

- Attendee communication: Frame the surcharge as optional and refund-eligible.

- Monitor feedback: Track chargebacks and customer comments; iterate as needed.

- Stay legally up to speed: Surcharging laws vary. Billfold keeps clients compliant state by state.

Take New York Cities laws surrounding Credit Card Surcharging that recently went into effect by the New York City Department of Consumer and Worker Protection (DCWP):

Important Message From the New York City Department of Consumer and Worker Protection (DCWP) Regarding New Guidelines for Businesses About the Application of Credit Card Surcharges.

These guidelines are essential for ensuring compliance and avoiding potential penalties.

Here's a brief overview of the key points:

- Surcharge Limitations: NYC businesses can charge a fee for credit card payments, but it cannot exceed the cost of processing the transaction. The surcharge must be clearly disclosed before the customer completes their purchase.

- Transparent Disclosure: The surcharge must be prominently displayed at the point of sale whether in-store, online, or via a receipt so that customers are fully aware of the extra charge.

- Card Types: The surcharge applies only to credit card payments, not debit cards or other forms of payment like cash or checks. Additionally, the surcharge must not exceed the merchant's processing costs for each credit card type.

- Prohibited Practices: Businesses cannot add a surcharge on government-issued cards or cards that do not have a credit function. Also, the total price including any surcharge must be displayed clearly at the checkout.

- Enforcement and Penalties: Non-compliance could lead to fines or other penalties, so it is important to ensure your practices align with the new.

“We have seen in the last few years service fees and convenience fees crop up at various types of businesses.” “I think that merchants increasingly are passing on costs to consumers in a more explicit fashion.”

John Cabell, Managing Director of Payments Intelligence for J.D. Power.

The Bottom Line

Credit card surcharging is a strategic investment that enables fair pricing, maintains margins, and keeps the experience frictionless for concert-goers. With Billfold POS, event operators gain:

- Risk-free compliance

- Revenue recovery mechanisms

- Data to support financial decision-making

By embracing surcharging thoughtfully, music events stay financially healthy while delivering the seamless experience fans expect.

Billfold POS isn't just your point-of-sale system, it’s your partner in pioneering transparent, profitable, and modern payment solutions for the live-music industry.