Why Cashless Payment Systems Continue Dominating Into 2026

- RFID transactions complete in under two seconds, slashing wait times and keeping attendees engaged

- Guests consistently spend more per visit when using cashless systems compared to traditional payment methods

- Real-time data capture provides instant visibility into sales performance, vendor activity, and crowd behavior

- If your event still relies on cash, you're sacrificing revenue and frustrating your guests in an industry that has moved on.

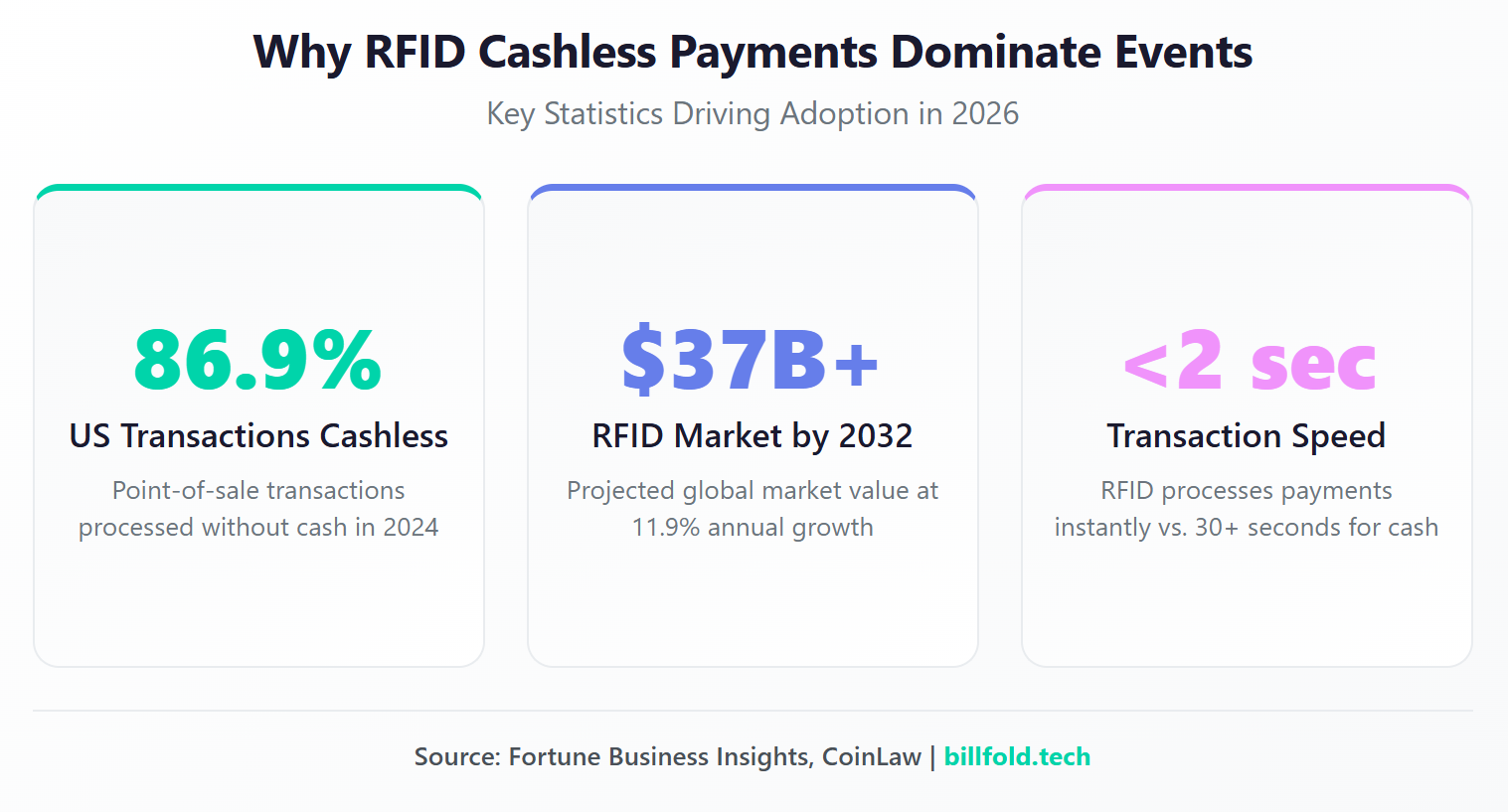

The global RFID market reached $15.49 billion in 2024 and is projected to grow at 11.9% annually through 2032, with the entertainment sector showing particularly aggressive adoption. From multi-day music festivals to single-night concerts, cashless payment solutions have become the expected standard rather than a novelty. Attendees no longer want to fumble with wallets or stand in endless lines. They expect a tap-and-go experience that keeps them immersed in the moment.

Cashless payment using RFID has emerged as the dominant solution for live events because it addresses fundamental problems that have plagued traditional payment methods for decades. Speed, security, and data intelligence combine to create an experience that benefits everyone involved. Attendees enjoy faster service, vendors process more transactions, and operators gain unprecedented visibility into their business. The technology has matured considerably, and the financial case for implementation has never been stronger.

What Is Driving the Surge in Cashless Payment Using RFID?

The shift toward RFID-enabled payment systems accelerated dramatically over the past several years, driven by a combination of changing consumer expectations and operational realities that event organizers can no longer ignore. Attendees have grown accustomed to contactless experiences in their daily lives, and they expect the same convenience when they walk through festival gates.

The numbers underscore this transformation. Globally, 85% of point-of-sale transactions were cashless in 2024, with the United States leading at 86.9%. This represents a fundamental shift in consumer behavior that extends directly into live entertainment. When guests tap their phones at coffee shops every morning, they arrive at your event expecting identical convenience.

Speed and Efficiency at Scale

Traditional payment methods create bottlenecks that frustrate attendees and cost vendors significant revenue. Cash transactions require counting, making change, and handling physical currency under pressure. Credit card payments involve chip insertions, PIN entries, and network delays that compound when thousands of people compete for drinks between sets.

An RFID event system processes transactions in a fraction of that time. A quick tap of a wristband completes the purchase, and the attendee moves on. This efficiency compounds across an event with thousands of transactions. Shorter lines mean more sales per hour, which translates directly into higher revenue for vendors and better experiences for guests. Operators who previously lost sales to impatient customers walking away from long queues now capture that demand.

Eliminating Cash Handling Headaches

Cash creates operational complexity that many event organizers underestimate until they experience a better alternative. Staff must be trained to handle money accurately under chaotic conditions. Secure cash rooms need to be established, monitored, and staffed throughout the event. End-of-night reconciliation becomes a multi-hour process prone to errors and discrepancies that can take days to resolve.

RFID tech for events eliminates these pain points entirely. With no cash changing hands, operators reduce the risk of theft, accounting errors, and employee disputes over missing funds. Staff spend less time counting drawers and more time serving customers. The settlement process becomes straightforward because every transaction is logged digitally with precise timestamps, location data, and item-level detail.

How Does an RFID Event System Boost Revenue?

Revenue growth is the metric that ultimately drives adoption decisions, and RFID systems deliver consistently strong results across diverse event types and scales. The combination of faster transactions and frictionless spending creates conditions where attendees naturally purchase more without feeling pressured.

Higher Per-Transaction Spending

Multiple analyses have documented the spending lift associated with cashless systems at events. When payment becomes effortless, attendees tend to make more impulse purchases throughout the day. The psychological barrier of handing over physical cash disappears. Loading funds onto a wristband in advance also creates a mental shift where that money becomes "event money" that guests are more willing to spend freely.

The impact shows most clearly at food and beverage locations. An attendee who might have skipped a second round because the line looked too long will happily tap their wristband when service moves quickly. Merchandise vendors see similar benefits when the transaction takes seconds instead of minutes. These small increases compound across thousands of attendees to produce meaningful revenue gains.

Real-Time Data for Smarter Decisions

One of the most powerful advantages of cashless and contactless POS systems is the data they generate in real time. Traditional cash-based events operate largely in the dark until the final count happens hours or days after the gates close. RFID systems provide immediate visibility that enables operators to make informed decisions while the event is still happening.

If a particular vendor is seeing heavy traffic while another sits idle, operators can redistribute staff or adjust signage accordingly. If a menu item is selling faster than projected, restocking can happen before supplies run out. This responsiveness improves the attendee experience and maximizes revenue capture across every opportunity. The data also proves invaluable for future event planning, revealing which vendors, products, and locations perform best.

What Are the Top Benefits of RFID Tech for Events?

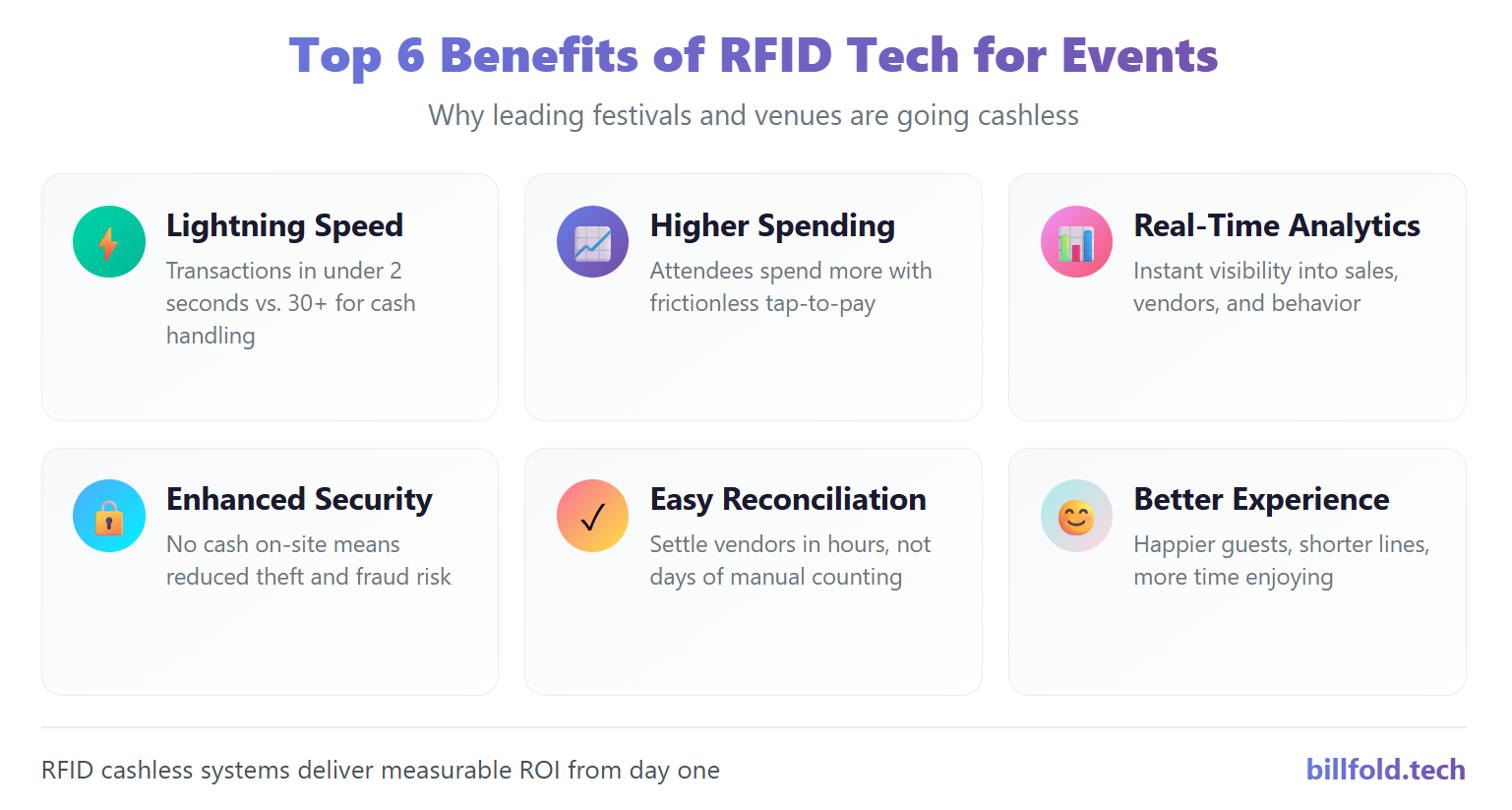

The advantages of implementing RFID payment systems extend across multiple dimensions of event operations. Here are the primary benefits driving rfid cashless adoption among forward-thinking organizers:

- Dramatically Faster Transactions: RFID payments complete in under two seconds, compared to thirty seconds or more for cash handling. This speed difference transforms the guest experience during peak periods when every second of efficiency matters.

- Increased Per-Capita Spending: The convenience of tap-to-pay removes friction from purchasing decisions. Research across multiple event types shows that attendees consistently spend more when using RFID wristbands compared to cash or traditional card payments.

- Comprehensive Data Analytics: Every transaction generates detailed data including timestamp, location, item purchased, and customer identifier. This information enables sophisticated analysis of attendee behavior and vendor performance that was previously impossible to capture.

- Enhanced Security: With no cash on-site, the risks of theft, robbery, and employee pilfering drop dramatically. Digital transaction records also make fraud detection and dispute resolution straightforward when issues arise.

- Simplified Reconciliation: End-of-event accounting becomes a data export rather than a manual count. Operators can close out vendor settlements within hours instead of days, reducing administrative burden and accelerating cash flow.

- Improved Attendee Experience: Guests appreciate the convenience and speed of cashless payment. Positive payment experiences contribute to overall event satisfaction and increase likelihood of return attendance.

Why Is RFID Cashless Adoption Accelerating in 2026?

The trajectory of rfid cashless adoption shows no signs of slowing. Several converging factors are pushing more events toward RFID implementation while making holdouts increasingly conspicuous to attendees who have experienced better alternatives elsewhere.

Consumer Expectations Have Shifted Permanently

The expansion of contactless payment options in retail, transit, and hospitality has fundamentally changed what consumers expect from payment experiences. Attendees who tap to pay for their morning coffee and evening grocery run expect the same experience at weekend festivals. Events that require cash or traditional card processing feel dated by comparison.

Younger demographics in particular view cashless payment using RFID as baseline functionality rather than an upgrade. Festival producers and venue operators competing for this audience recognize that payment experience is part of the overall brand impression. Clunky checkout processes undermine the seamless, premium atmosphere that modern events aim to create. When competitors offer tap-and-go convenience, continuing with cash handling becomes a competitive disadvantage.

Operator ROI Is Undeniable

The business case for RFID implementation has strengthened as the technology has matured and costs have decreased. Early adopters paid premium prices for systems that required significant customization and ongoing support. Today's solutions are more standardized, easier to deploy, and deliver clear returns that justify the investment.

The revenue uplift from faster transactions and increased spending typically covers implementation costs within the first event. Ongoing operational savings from reduced cash handling and streamlined reconciliation add to the financial advantage year after year. For operators evaluating whether to invest in an rfid event system, the numbers consistently support moving forward rather than waiting.

Data Capture Has Become Essential

Modern event operations depend on data that traditional payment methods simply cannot provide. Understanding which products sell at which locations during which time periods enables optimization that improves both revenue and attendee satisfaction. Identifying high-value customers allows targeted marketing that drives repeat attendance and increased lifetime value.

Cashless payment using RFID generates this data automatically with every transaction. Operators gain visibility into purchasing patterns that inform everything from vendor placement to staffing schedules to menu pricing. This intelligence becomes increasingly valuable as competition for attendee attention and spending intensifies across the live entertainment industry.

How Do Event Operators Get Started with RFID?

Implementing cashless payment using RFID requires thoughtful planning but is far from insurmountable. The process typically begins with selecting a technology partner who can provide the hardware, software, and support infrastructure needed for a successful deployment.

Key considerations include integration with existing ticketing systems, vendor onboarding processes, and attendee communication strategies. Successful implementations involve clear messaging to guests about how the system works before they arrive, easy options for loading funds both online and on-site, and visible support resources for anyone who encounters issues during the event.

Staff training is another essential element. Vendors need to understand how to process transactions, handle refunds, and troubleshoot common problems. A well-prepared team ensures that the technology works smoothly and attendees leave with positive impressions that enhance your event's reputation.

Security protocols deserve careful attention as well. While RFID systems eliminate many traditional security concerns, they introduce new considerations around data protection and system access. Working with experienced providers who understand these requirements helps ensure that your implementation meets industry standards and protects both your business and your guests.

Frequently Asked Questions

How does cashless payment using RFID actually work? Attendees receive an RFID-enabled wristband or card that stores payment credentials. They conntect the card to the wristband either online before the event or at on-site kiosks. At points of sale, a quick tap against a reader completes the transaction and deducts the amount from their balance instantly.

What happens if an attendee loses their RFID wristband? Most systems tie wristbands to registered accounts, allowing lost wristbands to be deactivated immediately and remaining balances transferred to a replacement. Attendees should register their wristbands online before the event to enable this protection and simplify the replacement process.

Can RFID systems handle high-volume events reliably? Yes. RFID systems are specifically designed for high-throughput environments. Because transactions complete in seconds and do not depend on external network connectivity for authorization, they scale effectively even at events with tens of thousands of attendees making simultaneous purchases.

Do attendees get refunds for unused funds? No need for refunds with Billfold because the system only charges what the customer has spent.

Take Your Event Cashless with Confidence

The popularity of RFID cashless systems reflects their proven ability to improve every dimension of event operations. Faster transactions, higher revenue, richer data, and better attendee experiences combine to make cashless payment using RFID the clear choice for events that want to deliver modern, professional experiences that meet contemporary expectations.

The market momentum confirms the trend. With the RFID market growing at nearly 12% annually and North America holding 37.7% market share, the infrastructure supporting these systems continues expanding and improving. Operators who implement now benefit from mature technology while positioning themselves ahead of competitors who continue delaying.

Billfold provides comprehensive RFID payment solutions designed specifically for festivals, concerts, and live events. From wristband provisioning to real-time analytics dashboards, every element of the platform is built to help operators maximize revenue and minimize friction. Ready to bring your event into the cashless era? Get in touch with the Billfold team to start the conversation.