Open Loop vs Closed Loop Payment Systems: What's the Real Difference?

Payment systems fundamentally shape customer experience and business operations, with open loop systems offering universal acceptance while closed loop systems provide enhanced control and loyalty benefits.

Key findings:

- Open loop systems enable transactions across multiple networks and financial institutions

- Closed loop systems operate within specific ecosystems, offering lower fees and better data control

- Businesses increasingly adopt hybrid approaches combining both system advantages

- Implementation choice depends on customer base, transaction volume, and business goals

Payment processing decisions can make or break customer satisfaction and operational efficiency. While 86.9% of US transactions are now cashless, the choice between open loop and closed loop payment systems determines how effectively businesses can serve customers and gather valuable transaction data.

What Are Open Loop vs Closed Loop Payment Systems?

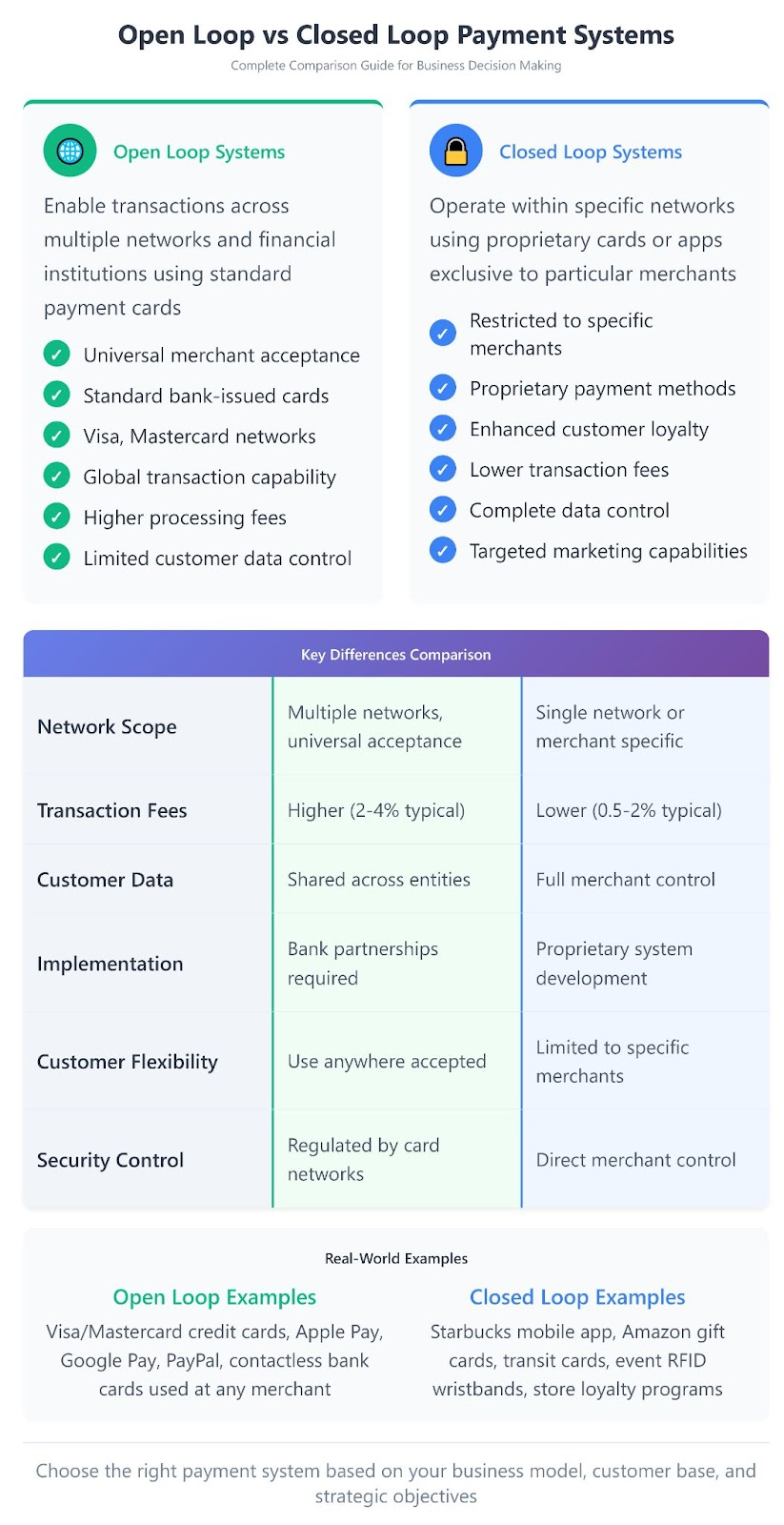

Open loop payment systems facilitate transactions across various networks, allowing customers to use standard debit cards, credit cards, or digital wallets at any participating merchant. These systems connect different financial institutions through shared networks like Visa and Mastercard, enabling universal acceptance and flexibility.

Closed loop payment systems operate within specific networks or ecosystems where transactions are restricted to designated merchants or service providers. Popular examples include store-specific apps, gift cards, and venue-specific payment solutions that create controlled spending environments.

The fundamental difference lies in network scope and merchant acceptance. Open loop systems prioritize universal compatibility, while closed loop systems focus on creating dedicated customer experiences within specific business ecosystems.

Key Differences Between Open Loop and Closed Loop Systems

Understanding the core distinctions helps businesses make informed payment processing decisions:

Network Accessibility

Open loop systems connect across multiple financial institutions and payment networks, enabling customers to use virtually any payment method. Closed loop systems restrict transactions to specific networks or merchant ecosystems, limiting where customers can spend loaded funds.

Card Issuance and Management

Open loop payments utilize standard bank-issued cards from major networks like Visa and Mastercard. Closed loop systems rely on proprietary cards, apps, or digital wallets specific to individual businesses or brand families.

Transaction Processing Fees

Closed loop systems typically involve lower transaction fees because they bypass external card networks and traditional banking infrastructure. Open loop systems include multiple intermediaries, resulting in higher processing costs but offering a broader market reach.

Customer Data Control

Closed loop systems provide merchants with complete visibility into customer spending patterns, purchase history, and behavioral data. Open loop systems share transaction data across multiple entities, limiting individual merchant access to comprehensive customer insights.

Implementation Requirements

Open loop acceptance requires establishing relationships with banks and payment processors, plus point-of-sale systems compatible with major card networks. Closed loop implementation involves creating proprietary payment infrastructure or joining specific merchant networks.

Advantages of Open Loop Payment Systems

Universal Customer Acceptance

Open loop systems accommodate any customer with a standard payment card or digital wallet, eliminating barriers to purchase. This inclusivity expands potential customer base without requiring specific app downloads or account registrations.

Global Transaction Capability

International customers can seamlessly make purchases using familiar payment methods. Open loop systems processed over 70% of North American online purchases in 2024, demonstrating their widespread adoption and reliability.

Reduced Customer Friction

Customers use existing payment methods without learning new systems or creating additional accounts. This familiarity reduces checkout abandonment and improves conversion rates across various business types.

Advantages of Closed Loop Payment Systems

Enhanced Customer Loyalty - Closed loop systems encourage repeat business by creating dedicated spending environments. Customers who load funds onto proprietary accounts tend to return more frequently and spend higher amounts per visit.

Superior Data Analytics - Merchants gain complete visibility into customer purchasing behavior, enabling targeted marketing campaigns and personalized experiences. This data control supports advanced customer analytics and inventory optimization.

Operational Cost Reduction - Lower transaction fees and reduced payment processing complexity decrease operational expenses. Businesses can reinvest these savings into customer experience improvements or business expansion.

Security and Fraud Prevention - Limited network scope reduces fraud vulnerability compared to open systems. Merchants can implement specialized security measures and monitor all transactions within controlled environments.

Implementation Considerations for Businesses

Which System Fits Your Business Model?

High-Volume Retail Operations

Businesses serving diverse customer bases benefit from open loop systems that accommodate any payment method. Retail stores, restaurants, and service providers should prioritize universal acceptance over data control.

Loyalty-Focused Businesses

Companies building strong customer relationships through rewards programs find closed loop systems more effective. Event venues and entertainment properties particularly benefit from controlled payment environments that enhance customer experience.

Hybrid Implementation Strategies

Many businesses combine both approaches to maximize benefits. Modern payment solutions enable customers to link existing payment cards to venue-specific systems, providing convenience and data control simultaneously.

Technical Infrastructure Requirements

Open Loop Implementation - Businesses must establish merchant accounts with acquiring banks, integrate point-of-sale systems compatible with major card networks, and maintain compliance with payment card industry standards.

Closed Loop Development - Creating proprietary payment systems requires significant technical investment in secure payment processing, customer account management, and regulatory compliance infrastructure.

Real-World Examples and Use Cases

Retail and Hospitality Success Stories

Starbucks held $1.8 billion in stored value on its mobile app as of 2024, with 31% of all US transactions now processed through their closed loop system, demonstrating how proprietary payment solutions drive customer loyalty and increase spending frequency.

Hospitality properties increasingly adopt RFID-enabled payment solutions that allow guests to make purchases throughout the property using linked payment cards, combining convenience with comprehensive spending tracking.

Transportation and Event Industries

Public Transit Evolution - London's Transport for London transitioned from closed loop Oyster cards to accepting contactless open loop payments, increasing ridership convenience while maintaining fare collection efficiency.

Festival and Event Applications - Event organizers implement RFID wristband systems that link to attendee payment cards, creating secure closed loop environments with open loop convenience.

Future Trends and Hybrid Approaches

Digital Wallet Integration

Modern payment systems increasingly blur traditional boundaries between open and closed loop models. Digital wallets like Apple Pay and Google Pay function as both open loop systems when linked to bank cards and closed loop systems when used with specific merchants or loyalty programs.

Central Bank Digital Currencies (CBDCs)

Over 130 central banks are exploring CBDCs as of 2024, with China's digital yuan processing over $250 billion in transactions. These government-backed digital currencies could create new hybrid payment models combining open loop accessibility with closed loop control.

Real-Time Payment Growth

Real-time payment systems are expected to grow 15% annually, bridging the gap between traditional open and closed loop limitations through instant, secure transactions across different financial institutions.

AI-Powered Payment Optimization

Advanced analytics enable businesses to optimize payment experiences by automatically routing transactions through the most efficient system based on customer preferences, transaction size, and business objectives.

How Should Businesses Choose Between Systems?

Customer Base Analysis

Diverse Customer Demographics Businesses serving varied customer groups should prioritize open loop systems that accommodate different payment preferences and technological capabilities.

Regular Customer Focus

Companies building relationships with repeat customers benefit from closed loop systems that enable personalized experiences and loyalty program integration.

Transaction Volume Considerations

High-Volume Operations Businesses processing large numbers of small transactions often prefer closed loop systems that reduce per-transaction costs and streamline operations.

Occasional Large Transactions Companies handling infrequent, high-value sales typically choose open loop systems that accommodate various payment methods without customer registration requirements.

Technology Integration Requirements

Existing System Compatibility

Businesses must evaluate how payment systems integrate with current point-of-sale, inventory management, and customer relationship management platforms.

Scalability Needs Growing businesses should consider how payment systems will accommodate increased transaction volumes and expanding customer bases over time.

Frequently Asked Questions

Which payment system offers better security: open loop or closed loop? Closed loop systems generally provide enhanced security due to limited network scope and centralized control. However, both systems can implement robust security measures including encryption, tokenization, and fraud monitoring when properly configured.

Can businesses accept both open loop and closed loop payments simultaneously? Yes, many businesses successfully implement hybrid approaches that combine both payment types. Modern POS systems can process traditional card payments while also supporting proprietary payment methods and loyalty programs.

What are the typical transaction fee differences between systems? Closed loop systems typically charge 0.5-2% lower transaction fees compared to open loop systems because they eliminate intermediary payment networks. However, implementation and maintenance costs may offset these savings for smaller businesses.

How do customers benefit from closed loop payment systems? Customers often receive enhanced loyalty rewards, personalized offers, faster checkout experiences, and simplified payment management within specific merchant ecosystems. However, they sacrifice payment flexibility across multiple merchants.

What industries benefit most from closed loop payment implementation? Entertainment venues, restaurants with strong loyalty programs, transit systems, corporate campuses, and event organizers typically see the greatest benefits from closed loop payment systems due to repeat customer interactions and controlled spending environments.

Transform Your Payment Strategy: Which System Will Drive Your Business Forward?

Open loop vs closed loop payment systems serve different business objectives, with the optimal choice depending on customer demographics, transaction patterns, and strategic goals. While open loop systems maximize customer accessibility and convenience, closed loop systems enhance loyalty and provide valuable business insights.

The payment landscape continues evolving toward hybrid models that combine universal acceptance with personalized customer experiences. Businesses should evaluate their specific needs, customer preferences, and growth objectives when selecting payment processing solutions.

Ready to implement the perfect payment solution for your business? Billfold offers innovative payment technology that combines open loop flexibility with closed loop benefits, helping businesses optimize customer experience while maximizing operational efficiency.